On December 24, the license-awarding ceremony for the first national batch of pilot institutions for the standardized business scope of credit control services was held at the Qianhai One-stop Service Center. The official issuance of business licenses to the first batch of pilot institutions marks another crucial step forward in the standardized development of credit control services, injecting the “Qianhai Momentum” into the high-quality development of China’s credit service industry nationwide. Huang Xiaopeng, Deputy Secretary of the Party Working Committee of Qianhai Cooperation Zone and Executive Deputy Director of the Qianhai Authority, and Li Guowei, Member of the Party Leadership Group and Deputy Director of the Shenzhen Municipal Administration for Market Regulation, attended the event.

To accelerate the construction of a pilot zone for credit economy, Qianhai has steadfastly taken institutional innovation as the core, focused on industry supervision, deepened reform and innovation, strived to resolve compliance pain points in the credit service industry, and delivered targeted services to meet the development needs of enterprises and market demands. In July this year, the State Administration for Market Regulation gave approval to Qianhai to launch a pilot program for standardizing the business scope of credit control service institutions, allowing such institutions to add business scope descriptions including credit information technology consulting, credit data processing services and occupational credit control consulting services to their business licenses. This move has unified the “language system” for industry market access at the institutional level. The Shenzhen Municipal Administration for Market Regulation and the Qianhai Authority responded promptly and carried out efficient coordination, providing clear guidance for the registration of credit control service institutions. The implementation of this pilot program will further regulate the order of the credit service market, stimulate the vitality of the credit service industry, drive innovation and optimization of credit service products across more sectors and application scenarios, and continue to unleash the value of credit in enhancing risk prevention and control and reducing systemic transaction costs.

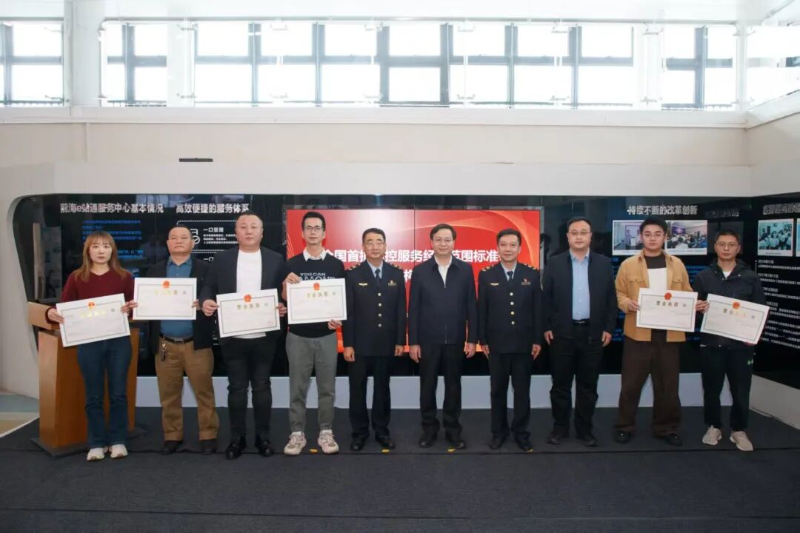

At the ceremony, the responsible official of the Credit Department of the Shenzhen Municipal Administration for Market Regulation briefed the attendees on the pilot work for standardizing the business scope of credit control service institutions, and the responsible official of the Shenzhen Municipal Enterprise Registration Authority issued business licenses to the first six pilot institutions, including First Share Intelligence and Runze Credit Control. It is learned that all the selected pilot institutions boast strong strength and distinctive characteristics, covering multiple sectors such as human resource risk management, intelligent risk control and data services. They will focus on expanding non-financial credit services including credit investigation and commercial account management, injecting fresh vitality into the credit service ecosystem of Qianhai.

In September this year, the Qianhai Authority, in conjunction with the Shenzhen Municipal Administration for Market Regulation, issued the 12 Measures for the High-level Development of a Pilot Zone for Credit Economy and the High-quality Growth of the Credit Service Industry in Qianhai, with a key focus on supporting credit service institutions to explore non-financial application scenarios. Credit service institutions that effectively help enterprises strengthen credit risk prevention and control and provide comprehensive credit information reports on enterprises’ solvency are entitled to a maximum annual subsidy of 3 million RMB per institution. Up to now, Qianhai has gathered more than 200 credit service institutions of various types, including two filed corporate credit investigation institutions in Guangdong Province (among 11 such institutions across the province) — Shenzhen Credit Reference and Qianhai Credit Reference Center, as well as a number of industry-leading enterprises such as China Securities Credit Enhancement, Dashu Credit Technology and Novelties Integrity.

Going forward, with strong support from the Shenzhen Municipal Administration for Market Regulation, the Qianhai Authority will collaborate with Nanshan District and Bao’an District. Building on the existing industrial foundation and combining innovative pilots with special policies, Qianhai will accelerate the construction of a full-chain credit service ecosystem, foster a first-class business environment, and support more high-quality credit service institutions to gather momentum and achieve sound development in the Qianhai Cooperation Zone.